Browsing the Real Estate Market: Safeguarding Tough Cash Fundings for Building Acquisition

In the detailed landscape of actual estate purchases, safeguarding difficult cash loans can be a calculated device for capitalists looking to promptly utilize on possibilities in the marketplace. The procedure of obtaining these finances involves browsing a special set of factors to consider and requirements that set them besides typical financing options. Recognizing the nuances of hard cash car loans, from certifying criteria to the advantages they supply, is vital for success in residential property purchase undertakings. As we dive into the details of this alternate funding avenue, a detailed guide to properly safeguarding hard cash loans and enhancing home procurements will certainly be revealed.

Understanding Tough Money Car Loans

When seeking choice funding choices genuine estate financial investments, possible customers might transform to difficult money finances as a practical service. Hard cash financings are asset-based lendings safeguarded by the residential or commercial property itself, making them attractive to investors that might not satisfy the rigorous demands of conventional lending institutions. Unlike conventional mortgages, difficult cash car loans are normally released by exclusive financiers or firms and have shorter terms varying from 6 months to a few years.

Interest prices on difficult cash car loans are higher than conventional fundings, frequently varying from 7% to 12%, mirroring the enhanced risk for the lender. Recognizing the terms, conditions, and payment expectations of hard cash car loans is critical for debtors to make informed choices and leverage this financing option efficiently in their property purchase undertakings.

Standard for Qualifying

To determine eligibility for hard cash lendings, borrowers must satisfy specific standards established forth by loan providers based on the residential property's worth and the consumer's financial situation. One key requirement for certifying for a difficult money finance is the loan-to-value (LTV) proportion, which is the proportion of the financing amount to the evaluated worth of the building.

Furthermore, consumers are frequently needed to have a substantial quantity of equity in the property to secure the financing. Lenders might additionally think about the borrower's leave technique, such as just how they plan to settle the finance, whether via the sale of the property or refinancing. While conventional loan providers concentrate on the customer's creditworthiness, hard money loan providers focus extra on the building's prospective and the consumer's capability to carry out an effective financial investment approach.

Advantages of Hard Cash Loans

Hard cash loans supply capitalists a distinct opportunity to protect financing rapidly based on the worth of the home being made use of as security rather than standard credit-based standards. One significant advantage of hard cash financings is the rate at which they can be obtained.

Furthermore, difficult cash financings supply more adaptability for investors. These lendings are normally asset-based, indicating the borrower's credit report and monetary history are of much less value (hard money loans in ga). This flexibility can be particularly beneficial for actual estate financiers that may not meet the rigorous demands of conventional lenders yet have beneficial buildings to offer as collateral

Additionally, difficult money car loans can be an eye-catching option for investors seeking to take advantage of their existing assets. By utilizing the building being acquired as security, financiers can protect the funding needed without locking up their fluid assets. This can supply investors with the possibility to tackle multiple projects concurrently, maximizing their prospective returns in the actual estate market.

Finding Lenders

Finding reputable hard money lenders is vital for real estate financiers seeking efficient financing services based on home collateral. Furthermore, getting to out to genuine estate representatives, home loan brokers, or various other capitalists that have experience with difficult money fundings can lead to suggestions for trustworthy loan providers.

Many difficult cash loan providers have web sites where they describe their financing programs, terms, find out here and needs. It's vital to extensively study and veterinarian any lender before devoting to a car loan arrangement.

Tips for Effective Procurement

For a smooth and successful home acquisition process, actual estate capitalists need to focus on thorough due persistance and critical preparation. Carrying out a thorough evaluation of the home, its market worth, capacity for recognition, and any kind of existing liens or encumbrances is necessary. Financiers should also think about factors such as the building's place, community fads, and features that can affect its desirability and resale worth.

In addition, having a clear financial investment technique and departure plan is important for successful home purchase. Whether the objective is to refurbish and turn the home for a fast profit or hold it for lasting rental earnings, investors must align their funding options and timelines appropriately.

Conclusion

To conclude, safeguarding tough cash loans for property procurement can be a practical alternative for genuine estate capitalists (hard money loans in ga). Comprehending the criteria for qualifying, the benefits of these fundings, and finding respectable lenders are essential action in navigating the property market efficiently. By adhering visit this page to these ideas and guidelines, investors can raise their chances of getting the necessary funding to expand their property profiles

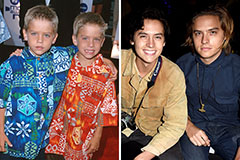

Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! James Van Der Beek Then & Now!

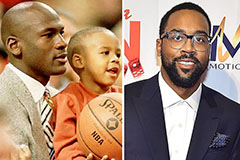

James Van Der Beek Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now!